Company search in Spain

Welcome to Companysearch.ES, the best supplier of Spanish company searches and full reports retrieved from official sources including shareholder information

Order your search right now by typing the company name in the following form field:

What is included

To obtain the most information available for a Spanish company different documents have to be retrieved from different sources. Our local team can retrieve documents for Spanish companies registered in any location including Balearic Islands, Catalonia, Canary Islands, Ceuta and Melilla. A Spanish Company Search report contains the following documents: Registry Extract, Financial Statement (if available), Real Estate check and Initial Shareholders Report

Registry Extract

This document is issued by the "Colegio de Registradores", an Association of the Spanish Company Registrars. There are 52 Registrars, one for each Spanish Province. They are called "Registros Mercantiles". Apart from the mentioned Association, there is a Central Registrar (RMC, Registro Mercantil Central). Each local Registrar has to send company information to the Central Registrar but the Extracts are more detailed when retrieved from the Association "Colegio de Registradores".

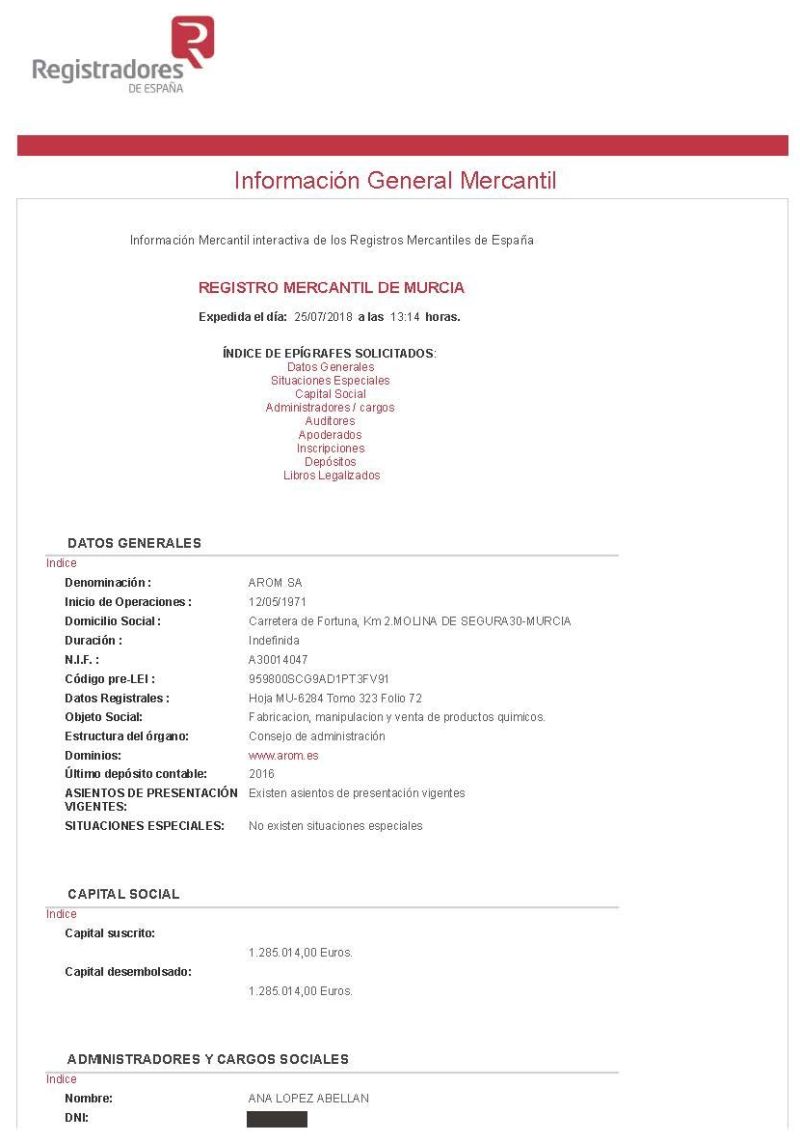

Here's the first page of a sample Registry Extract

Registry Extract Contents

- "Registro Mercantil"

- This is the name of the local Registrar where the company is currently registered. Companies can move from one Registrar to another.

- "Expedida el día"

- This is the date and time where the Extract was issued. It's a very important file as company information and status may vary in real time.

- "Índice de epígrafes solicitados"

- This is a list of the different sections of the Extract.

- "Datos Generales"

- General data

- "Situaciones Especiales"

- Special Situations

- "Capital Social"

- Share Capital

- "Administradores / Cargos"

- Directors / Officers

- "Auditores"

- Auditors

- "Apoderados"

- Agents / Representatives

- "Inscripciones"

- Filings with a sequential number. The incorporation of a company is the filing 1 "inscripción 1" and so on...

- "Depósitos"

- Financial Statements

- "Libros Legalizados"

- Internal Company Registers Metadata

- General Data

- This lists the main data about the company including the latest financial statement

- "Denominación"

- Full company name

- "Inicio de Operaciones"

- Operations start date

- "Domicilio Social"

- Registered office

- "Duración"

- Company duration

- "NIF"

- Company number. In Spain this number equals the VAT Number

- "Código pre-LEI"

- Legal Entity Identifier. If the company hasn't requested it a temporary LEI code is shown

- "Datos Registrales"

- Registry data. Physical location of the book, sheet, etc..

- "Objeto Social"

- Company purpose

- "Estructura del Órgano"

- This is the company's type of governance. It can be: a sole director "administrador único", board of directors "consejo de administración", joint and several directors "administradores mancomunados" or joint directors "administradores solidarios".

- "Dominios"

- Internet domains registered by the company. This shows only the domains that the company has filed to the Spanish register

- "Último Depósito Contable">

- The fiscal year of the latest financial statement available. Most companies in Spain file accounts 6 months after the fiscal year has ended, and most of them have a fiscal year equal to a natural year

- Share Capital

- This section shows the subscribed capital "capital suscrito" and paid-in capital "capital desembolsado". The share capital for Spanish companies is shown in Euros. Paid-in capital can be asset based (non cash). This is called "aportación no dineraria". Many small companies are incorporated this way using office related assets such as computer equipment.

- Directors / Officers, Auditors, Agents

- These are the details of the current directors and other related people such as auditors and agents / representatives. Information is very exhaustive compared to other sources:

- "Nombre"

- Director name

- "DNI"

- National ID Number. Very useful to distinguish among similary named individuals

- "Cargo"

- Position

- "Fecha de nombramiento"

- Appointment date

- "Duración"

- Duration of the appointment, if any

- "Inscripción"

- Sequential filing number

- "Fecha Inscripción"

- Date when the appointment was filed to the Registrar

- "Fecha de la Escritura"

- Date when the appointment deed was signed

- "Notario/Certificante"

- Notary Public where the appointment deed was signed

- "Residencia"

- Place of residence of the director

- "Número de Protocolo"

- Deed number at the Notary Public

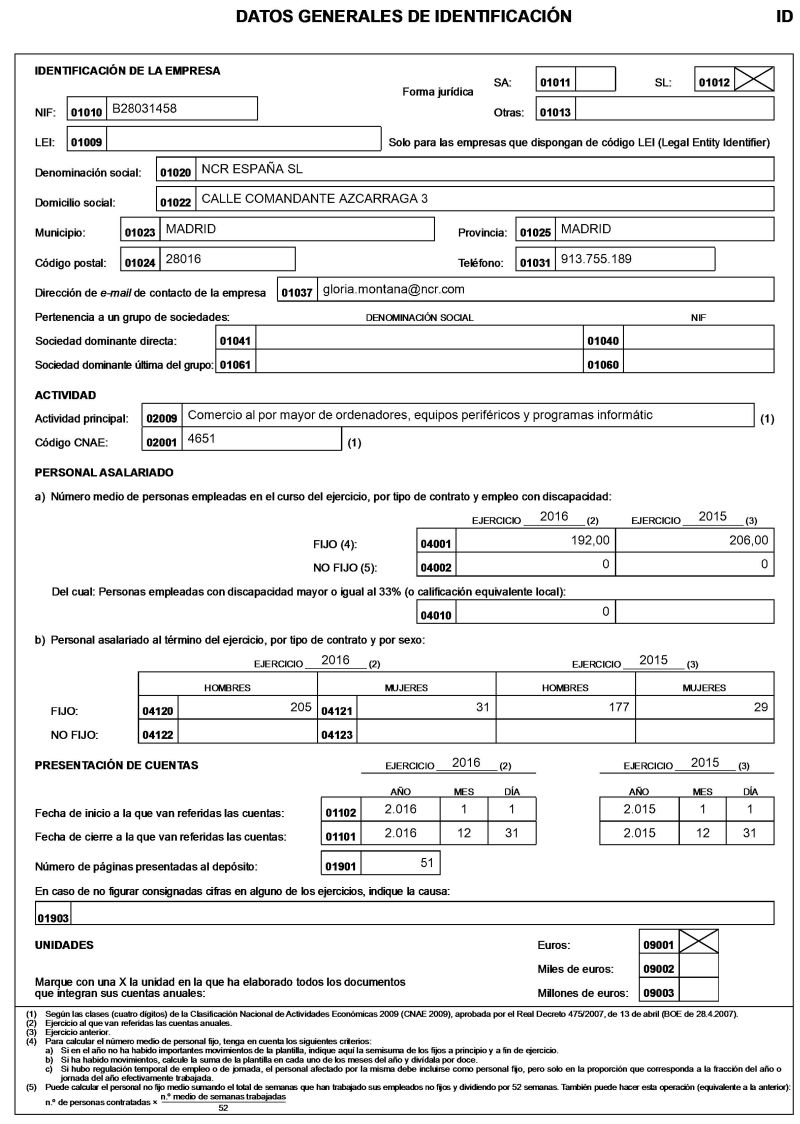

Financial Statement

Spanish companies file their financial statements, also named annual accounts "cuentas anuales" to the Spanish Tax Authority "Agencia Tributaria, AEAT", in order to be taxable for the Spanish Corporation Tax. This filing is named Model 200 - Corporation Tax "Impuesto de Sociedades".

After that, financial statements are also filed to the Company Registrar in a filing named annual accounts deposit "Depósito de Cuentas Anuales". The latter are available to the public after a variable processing period. For most Spanish companies annual accounts for the previous year are available from August.

Not all Spanish companies have financial statements available. This can happen for newly incorporated companies, inactive companies or companies that just refuse to file the annual accounts to the Registrar. Refusal of accounts filing can be due to defects in the documents or intentional as some companies prefer to pay the fine rather than disclosing their financials to competitors. Apart from the fine, companies in default for filing accounts are blocked in the registry from filing other documents.

We always include the latest financial statement available in our search report.

Depending on the company they can be large files with many pages. Notes to the Annual Accounts can be lengthy. However, there is a common format where the actual financials are shown. Here's the first page (identification of the company):

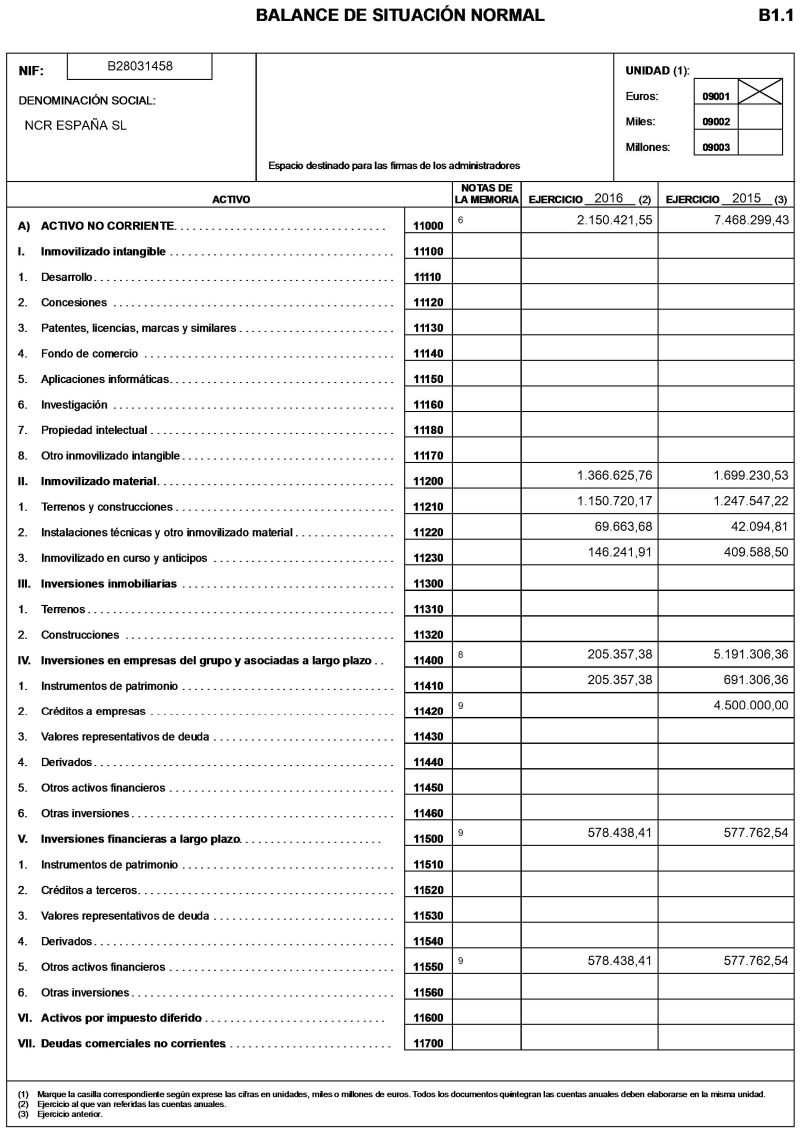

After this page, the standard financial data is displayed

Financial statements of Spanish companies can be normal or abbreviated. Abbreviated statements have a reduced level of disaggregation but important figures such as turnover, net profit, etc.. are available.

The two parts of an annual accounts statement of a Spanish company are:

- Balance sheet

- Profit and Loss Account

- Total assets less than 4 million euros

- Total net turnover less than 8 million euros

- Average number of employees less than 50

- Total assets less than 11 million euros

- Total net turnover less than 22.8 million euros

- Average number of employees less than 50

Translation Guide

Our reports consist of original documents are they are not translated. Our typical client needs the information quickly and prefers to order translations in-house. As the length of the documents varies we couldn't offer a standard rate and delivery timescale for translations.

However with our Spanish financial concepts translation guide it's easy to understand Spanish companies annual accounts

Financial concepts translation table

| Acreedores Comerciales y Otras Cuentas A Pagar | Trade Creditors and other account payables |

| Activo Corriente | Current Assets |

| Activo No Corriente | Non-Current Assets |

| Amortizaciones del inmovilizado | Amortisation of Fixed Assets |

| Bases de reparto | Distribution basis |

| Beneficios consolidados | Consolidated profits |

| Beneficios netos de impuestos | Net profits after taxes |

| Capital | Capital Stock / Share capital |

| Capital escriturado | Deeded Capital |

| Cargas sociales | Social charges |

| Cobros y pagos proyectados | Estimated receipts and payments |

| De valores negociables y otros instrumentos financieros | From tradable securities and other financial instruments |

| Deterioro y resultado por enajenaciones de instrumentos financieros | Impairment and Results for Disposal of Financial Instruments |

| Deterioro y resultado por enajenaciones del inmovilizado | Impairment and Result for Disposals of P. P&E |

| Deterioros y pérdidas | Impairment and losses |

| Deudores comerciales y otras cuentas a cobrar | Trade debtors and other account receivables |

| Distribución | Distribution |

| Dividendo a Cuenta | Interim Dividend |

| Dotación requerida | Provision required |

| Efectivo | Cash |

| Efectivo y otros activos líquidos equivalentes | Cash and other equivalent liquid assets |

| Estimación de beneficios | Net profit estimate |

| Fondos propios | Equity |

| Gastos de personal | Personnel Expenses |

| Gastos financieros | Finance Expenses |

| Importe neto de la cifra de negocios | Net Turnover |

| Importes adicionales a las tasas | Additional amounts to the income taxes |

| Impuesto de sociedades | Corporate Tax |

| Impuesto sobre beneficios | Income Tax |

| Imputación de subvenciones de inmovilizado no financiero y otras | Grants for Non-Financial Fixed Assets and Related Grants Release |

| Indemnizaciones | Indemnities |

| Ingresos accesorios y otros de gestión corriente | Non-Core and other current operating revenue |

| Ingresos financieros | Financial Income |

| Inversiones en empresas del grupo y asociadas a largo plazo | Investments in companies of the group with long-term association |

| Inversiones financieras a largo plazo | Long term financial investments |

| Otras operaciones con socios o propietarios | Other transactions with shareholders or owners |

| Otras variaciones | Other changes |

| Otras variaciones del patrimonio neto | Other changes in net assets |

| Otros Acreedores | Other Creditors |

| Otros deudores | Other debtors |

| Otros gastos de explotación | Other Operating Expenses |

| Otros gastos de gestión corriente | Other Current management expenses |

| Otros ingresos de explotación | Other Operating Income |

| Otros ingresos de negocio | Other Trading Income |

| Otros servicios exteriores | Another external services |

| Participaciones | Shares |

| Pasivo Corriente | Current Liabilities |

| Patrimonio Neto | Net Assets |

| Pérdidas, deterioro y variación de provisiones por operaciones comerciales | Loss, impairment and variation in provisions for trade operations |

| Por deudas con terceros | On debts to third parties |

| Porcentaje de Participación | Percentage of ownership |

| Prima de asunción | Share premium account |

| Prima de emision | Issue Premium |

| Reparaciones y conservación | Repairs and maintenance |

| Reserva Legal | Legal reserve |

| Reservas | Reserves |

| Reservas Voluntarias | Voluntary Reserves |

| RESULTADO ANTES DE IMPUESTOS | INCOME BEFORE TAX |

| RESULTADO DE EXPLOTACIÓN | OPERATING INCOME |

| Resultado de la Cuenta de Perdidas y Ganancias | Result of Profit and Loss Account |

| RESULTADO DEL EJERCICIO | NET INCOME (LOSS) FOR THE YEAR |

| RESULTADO FINANCIERO | FINANCE RESULT |

| Resultados por enajenaciones y otras | Results from disposals and others |

| Saldo Ajustado, Inicio del ejercicio | Adjusted balance, Start of the year |

| Saldo Final del Ejercicio | Ending balance for the year |

| Saldos de tesorería | Cash Balances |

| Servicios de profesionales independientes | Independent professional services |

| Servicios exteriores | External Services |

| Subvenciones de explotación incorporadas al resultado del ejercicio | Operating subsidies included in profit or loss |

| Sueldos, salarios y asimilados | Wages, salaries and similar expenses |

| Suministros y consumos | Consumption and supplies |

| Tarifas y otros | Tariffs and others |

| Total Activo | Total Assets |

| Total de Ingresos y Gastos Reconocidos | Total Income and Expenses |

| Total Patrimonio Neto y Pasivo | Total Net Assets and Liabilities |

| Trabajos realizados por la empresa para su activo | Company Works for its Asset |

| Traspaso del beneficio del ejercicio | Transfer of profit for the year |

| Tributos | Taxes |

Real Estate check

All local Land Registries in Spain maintain records of the owners that have at least one property under their name in the registry. It's not possible to retrieve the full list of properties directly, but it's the first step in locating any real estate assets owned by a company.

Initial Shareholders Report

Full shareholder information of Spanish private companies is not publicly available. However there are a number of government bodies which have this information. Companies have to include details of shareholders and percentages when filing their financial statements to the Tax Authority (form 200). The Tax authority won't disclose any of these details under Spanish tax law.

The initial shareholders are filed to the Company Registry and they are available under special request. Subsequent share transfers are registered at a Public Notary and they are not filed to the Registry. They are stored in a Notary Public propietary database which isn't available to the public neither

We are able to deliver an Initial Shareholders Report which lists the details of the initial shareholding structure of a Spanish private company

Sources

Searching Spanish companies can be complicated because there are many different government bodies and information sources involved and there is no single official search form.

Trade Registers

These are the local Company Registrars and there is one per Spanish province. It's possible to perform company searches at their offices and some of them have websites. Few of the websites have online services though. Each Spanish company is registered in one of these local registers.

Association of Trade Registers

The Association of Trade Registers offers limited online services connected to each local Register

Central Trade Register (RMC)

It's an independent centralized body. They keep a central index of companies and they also offer limited online services and they are responsible for negative name certifications, mandatory for new company registrations.

Official Company Gazette (BORME)

The Official Company Gazette is published by the national publishing authority. It's a daily list of changes and filings on Spanish companies. Not all filings are published, such as annual accounts. It's not searchable by company.

Tax Authority (AEAT)

This government body is responsible for corporation tax and it has a wide range of online services but only for company officers or agents. There are no company searches available for third parties.

Commerce Chambers

There is a global Spanish Commerce Chamber and also local ones. They are responsible for boosting business for small and medium Spanish companies. Through a private company they also sell company information, listings and self-employed data

News and updates

Spain makes significant advances in the fight against foreign bribery According to the Exporting Corruption Report 2020, for the first time in recent years, Spain made significant advances in enforcement against foreign bribery, including a small improvement in prevention and detection measures.